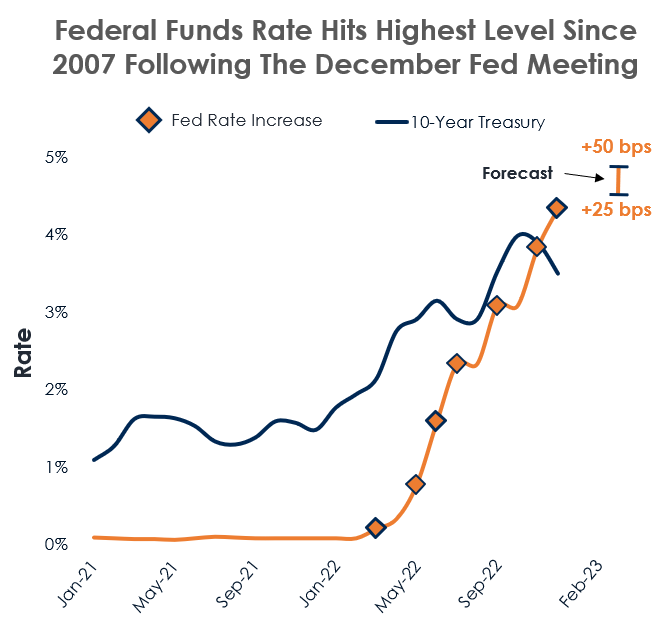

Fed Slows The Pace Of Rate Hikes

- As expected, the Federal Reserve raised the overnight rate 50 bps to a lower bound of 4.25%, following 4 consecutive 75 bps lifts

- Chairman Powell suggested that the terminal rate may have risen, but set expectations for a slowing pace of increases over the course of 2023

Why Is The Fed Easing Rate Movement

- While inflation of 7.1% is well above the 2% target, this figure has fallen 110 bps since September

- Other key indicators like housing, car prices, and gas prices slipped from recent peaks towards the end of 2022

What This Means For CRE Markets

- Slower, smaller rate increases will reduce uncertainty and give the market time to recalibrate. That will help narrow the buyer/seller expectation gap.

- If the Fed continues down the path of smaller hikes in 2023 and inflation manages to ease, we could see buyer competition for assets heat up quickly.

*10-Year Treasury through December 14, 2022

Assumes one 25-50 bps hike at the FOMC meeting in February 2023

Sources: Marcus & Millichap Research Services, Federal Reserve

Watch the Video Below